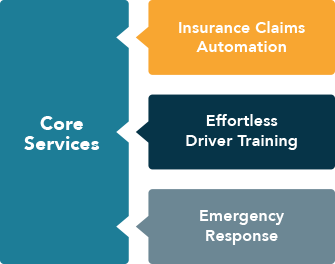

Sfara’s Core Services

- Crash detection (even at low speeds) with false positive suppression and superior data for crash reconstruction

- Trip and driving data for UBI

- Personal safety with Sfara Triple-Tap™

Pre-Enabled Solutions

- FNOL and Insurance claims automation

- Effiziente Anpassung des Fahrerverhaltens

- Emergency response

Detecting a crash event, even at all speeds or when the vehicle is not moving, is realized through our patented on-device AI that can analyze sensor data and quickly communicate impact details, severities and confidence.

Empowers a range of possible solutions, including claims management, accident reconstruction and fraud detection.

Detects a wide range of driving behaviors, such as Hard Braking, Rapid Acceleration and contextual Phone Handling and Speeding, which can be used to understand risk and measurably drive it down.

Sfara’s advanced personal safety solutions offer three distinct ways to get help when the situation doesn’t feel right. Triple-Tap the device and a Safety Coordinator will call the user. Schedule a Check-in Call from the Coordinator if the timer runs out. Or, swipe a manual SOS.

Dismissing a potential impact, especially at low speeds, requires a momentary data and situational awareness. This is why Sfara has developed several leading-edge technologies including self diagnostics, intelligent trip start/end, mode of transportation detection and deterministic physics modeling that force multiply each other to create a powerful false positive suppression technology (see below).

Integrated Suppression Framework

Sfara’s goal has always been to develop technologies for enterprises who are often entrusted with safety-of-life. As a result, our technologies and methodologies demanded superior approaches.

Our experience as pioneers in the connected vehicle industry informed us that false positive detections are perpetually one of the biggest challenges to running a successful program. Yet, false positive suppression isn’t something you can affix to existing technology. It must be part of its DNA.

That’s why from our inception we focused heavily on integrating false positive suppression techniques into everything we do.

Auto insurers can seamlessly connect Sfara’s mobile crash detection data with CCC’s claims management solutions, improving and speeding claims outcomes.

Insurers leverage Sfara’s crash data through CCC’s software-driven workflows, powering auto damage and casualty claims, and supporting the ability to estimate damage severity, and schedule timely repairs. This creates a more straight-through experience for drivers and insurers.

Interested in participating as an early customer, speak to your CCC sales representative or contact us.

(available globally)

Easily enable an emergency response capability at lightning speed, managed by experienced leaders.

Depending on the solution you choose, you can get emergency response in over 45 countries and 15 languages.

Your customers get reassurance during stressful situations and expert response to true emergencies.

Through our partner integrations, your people are covered where they live and work, and even when they travel to covered regions.

Our Pre-integrated Partners

Bosch Service SolutionsRapidSOS

Sfara’s artificial intelligence analyzes driving data generated by smartphone sensors. This analysis identifies at-risk behaviors and patterns, which then triggers training that is automatically issued to drivers in order to curtail identified risks.

Most often, at-risk driving behaviors are self-corrected even before they result in an incident.

Fewer incidents means higher profits. No spending time and money on training.